- September 17, 2024

- by NCS Global

- 4mins read

In-House vs. Outsourced Accounting Services: The Ultimate Comparison.

As businesses grow, so do their accounting needs. Managing finances effectively is crucial to ensuring long-term success, but the question often arises: should you handle accounting in-house or outsource it to experts?

For Australian businesses, especially CPAs, accountants, and auditors, choosing between in-house and outsourced accounting services can greatly influence operational efficiency, cost management, and business growth. As NCS Australia specialises in providing outsourced accounting services, this comparison helps highlight the benefits of outsourcing, making it easier for firms to decide the best approach for their accounting needs.

At NCS Australia, we have seen firsthand the advantages and challenges of both approaches.

In-House Accounting Services: Pros and Cons

Pros:

1. Control and Accessibility: With an in-house team, you have direct control over your accounting processes and immediate access to financial data. This can be beneficial for businesses that need real-time insights and quick decision-making.

2. Customised Solutions: An in-house team can develop accounting practices that are closely aligned with your company’s specific needs and industry requirements.

3. Data Security: Handling your finances internally can enhance confidentiality, especially when dealing with sensitive financial information, ensuring that your data stays protected within the company.

Cons:

1. High Costs: Hiring, training, and retaining skilled accountants is expensive. This includes not only salaries but also benefits, software, and ongoing professional development.

2. Limited Expertise: In-house teams may lack the diverse expertise that an outsourcing company can offer. This is especially true in specialized areas like tax planning, compliance, and financial analysis.

3. Scalability Challenges: As your business grows, your accounting needs may become more complex. Scaling an in-house team to meet these demands can be challenging and costly.

Outsourced Accounting: Pros and Cons

Pros:

Cons:

Comparing In-House and Outsourced Accounting: Pros and Cons:

The Cost Conundrum

Expertise at Your Fingertips

In-House Accounting:

Demands ongoing training to keep up with ever-changing tax laws and regulations.

Risk of errors if the in-house team isn’t up-to-date on the latest practices.

Outsourced Accounting:

Offers immediate access to a team of experts who are continuously updated on legislation and best practices.

Ensures compliance and reduces the risk of costly errors.

Scalability Simplified

Focusing on What Matters

Technology & Innovation: Staying Ahead

Risk Management: Mitigating the Unknown

The NCS Australia Approach:

Outsourcing accounting isn’t just a cost-cutting measure; it’s a strategic decision that aligns with the broader goals at NCS Australia. By leveraging the strengths of outsourced solutions, we ensure that our financial operations are not only efficient and compliant but also scalable and innovative. This approach allows us to focus on delivering exceptional IT solutions while confidently leading the complexities of financial management.

Key Insights:

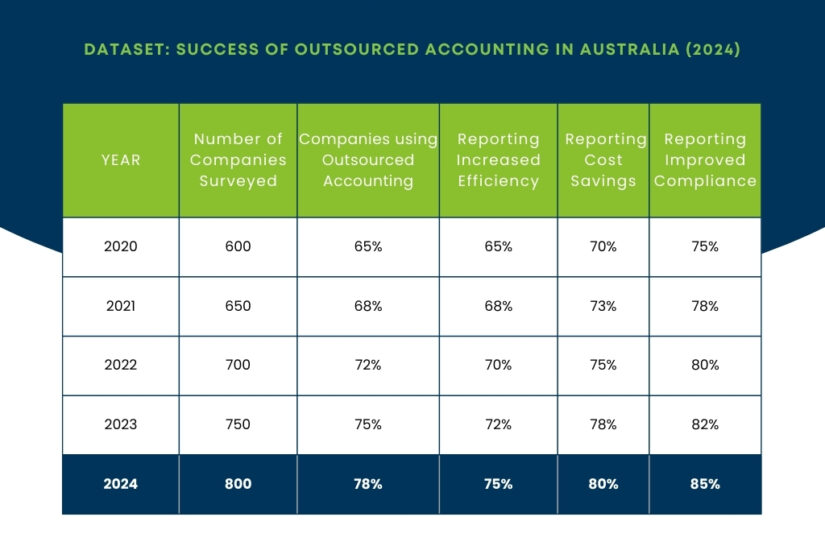

Growth in Adoption: The percentage of companies using outsourced accounting has steadily increased from 55% in 2018 to 75% in 2023, reflecting the growing trust in outsourcing as a viable business solution.

Efficiency Gains: Over 72% of companies in 2023 reported increased efficiency due to outsourced accounting, up from 60% in 2018.

Cost Savings: A notable 78% of companies in 2023 reported cost savings, showcasing the financial benefits of outsourcing.

Improved Compliance: Companies also saw a marked improvement in compliance, with 82% reporting better adherence to regulations in 2023, compared to 70% in 2018.

Conclusion:

The data clearly shows a rising trend in the popularity and effectiveness of outsourced accounting services in Australia. Businesses are focusing on managing operations and cutting costs, and outsourcing to NCS Australia can emerge as a strategic move that offers notable benefits in efficiency, cost-effectiveness, and compliance. These figures endorse NCS Australia suggestion to integrate outsourced accounting as a crucial element of any business strategy.