- November 8, 2024

- by NCS Global

- 3mins read

Transforming Back-Office Accounting with Outsourcing: What You Need to Know

Introduction:

Back-office accounting consists of essential but repetitive tasks that keep a firm running smoothly. These include bookkeeping, payroll, accounts payable, and data entry. While critical to business operations, these tasks often divert resources from client service and strategic growth opportunities.

1. What is Back-Office Accounting?

Back-office accounting includes essential but repetitive tasks that keep a firm running efficiently, such as bookkeeping, payroll, accounts payable, and data entry. These tasks, while critical, often consume resources that could otherwise be directed toward client service and strategic growth.

Key Compliance Areas: GST, BAS, and Payroll

For Australian businesses, compliance tasks are substantial. Outsourcing can ease the burden of managing GST (Goods and Services Tax), preparing Business Activity Statements (BAS), and ensuring payroll compliance. These tasks are complex and carry strict regulations, and failing to comply can result in penalties. Outsourcing ensures firms stay compliant with evolving regulatory standards, helping maintain client trust and minimise risk.

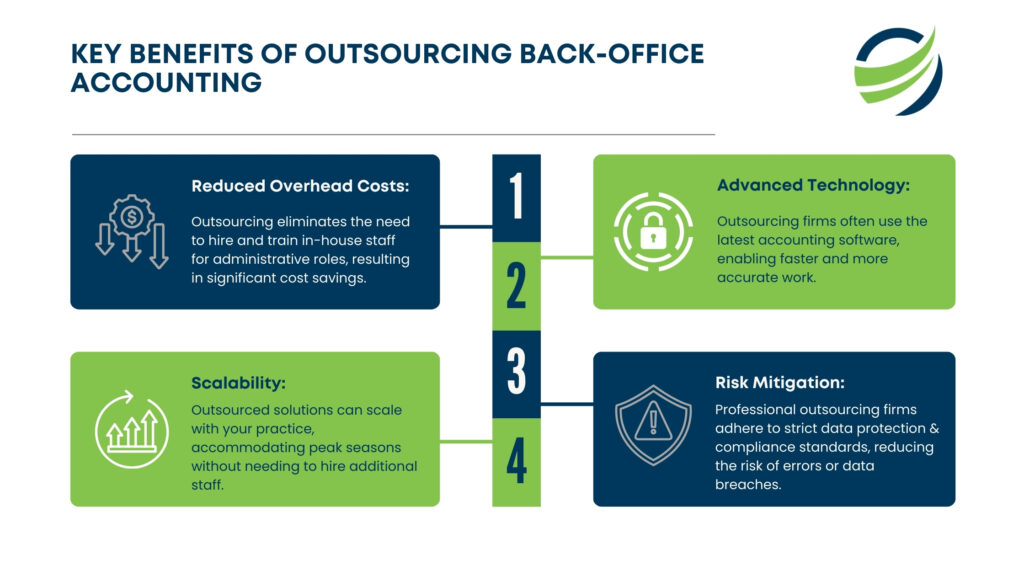

Benefits of Outsourcing Back-Office Functions:

Outsourcing back-office functions offers numerous advantages, from increased efficiency to cost savings. When firms delegate tasks such as BAS preparation or payroll management, they free up valuable time to focus on client relationships and growth opportunities. With the support of a trusted outsourcing partner, Australian firms can maintain compliance, reduce operational costs, and improve overall productivity.

2. Why Outsourcing is Ideal for Australian CPAs and Financial Advisors

In Australia’s competitive financial landscape, CPAs and financial advisors face pressure to deliver quick and accurate results. However, with limited time and resources, managing back-office accounting can often feel overwhelming. Outsourcing provides access to skilled professionals who can handle these tasks efficiently, meeting both industry standards and compliance requirements. This enables local practices to maintain high-quality service while alleviating operational burdens.

4. How Outsourcing Can Improve Efficiency and Client Satisfaction

By delegating back-office tasks to external experts, accounting firms can focus more on client-facing activities. This boosts client satisfaction as firms can provide a higher level of service, offering insightful guidance rather than simply managing data entry or reconciliations. Outsourcing can also streamline workflow, allowing firms to meet tight deadlines without sacrificing quality.

5. Cost-Effectiveness of Outsourced Accounting Services

For many firms, the primary reason to outsource back-office accounting is the cost benefit. Hiring in-house staff requires investment in salaries, benefits, and office infrastructure. With outsourcing, firms pay only for the services they need, significantly reducing overhead costs. This allows firms to manage budgets more effectively, especially if they are expanding or have seasonal needs.

6. Enhancing Data Security with Trusted Outsourcing Partners

Data security is paramount for accounting firms, and outsourcing partners often invest heavily in secure technology and data protection. These providers follow strict regulatory guidelines to protect client information, minimising the risk of data breaches. For Australian CPAs, accountants, and financial advisors, outsourcing can offer peace of mind, knowing that data is handled with the utmost confidentiality.

7. Meeting Compliance Standards through Outsourcing

In Australia, strict compliance and regulatory standards govern accounting practices. Managing compliance can be daunting, especially for small firms. Outsourcing firms specialise in regulatory standards and ensure compliance with laws and regulations, which means outsourced back-office work can contribute to a firm’s overall compliance and reputation.

8. Customisable Outsourcing Solutions for Every Firm

One of the main reasons CPAs and financial advisors choose outsourcing is flexibility. Outsourcing providers often offer customisable solutions, allowing firms to select specific services based on their unique needs. Whether it’s payroll processing or handling accounts payable, firms can customised outsourced services to fit their operational model, ensuring they only pay for what they truly need.

9. Access to Specialised Expertise Without Hiring Full-Time

Outsourcing enables firms to tap into specialised expertise on a project basis. For example, if a firm needs help with tax preparation or complex compliance tasks, an outsourcing provider can supply experienced professionals as needed. This arrangement allows firms to access high-quality expertise without the commitment or expense of full-time hiring.

10. How to Choose the Right Outsourcing Partner

Selecting the right outsourcing partner is crucial to reaping the full benefits of outsourcing. Key considerations include:

- Industry Experience: Choose a provider familiar with the accounting industry.

- Technology Stack: Ensure they use reliable accounting software compatible with your systems.

- Reputation and References: Look for reviews and case studies from similar firms.

- Security Protocols: Verify their commitment to data protection and compliance.

Conclusion:

Transforming back-office accounting with outsourcing offers transformative benefits for Australian CPAs, accountants, and financial advisors. With advantages ranging from cost reductions to improved client satisfaction and compliance, it allows firms to stay competitive, adapt to changing regulations, and provide high-quality client service. By partnering with a trusted outsourcing provider, firms can focus on what they do best—helping clients succeed—while leaving administrative tasks to experts.