- January 7, 2025

- by NCS Global

- 6mins read

Save costs and boost efficiency through Outsourcing.

In today’s competitive business landscape, many companies in the United States are turning to outsourcing as a strategic solution for managing their accounting needs. This approach not only streamlines financial operations but also aligns with essential aspects like Structuring Your Business, ensuring scalability and efficiency as your company grows.

Outsourcing accounting services for small businesses, in particular, can lead to significant benefits, including cost savings, access to expert knowledge, and increased operational efficiency. This approach, which often includes Outsourcing Payroll Duties, allows business owners to focus more on growth while leaving the financial management to skilled professionals.

This article will delve into how to outsource accounting services, exploring the reasons behind this approach, where to find suitable providers, and key factors influencing costs.

Why Outsource Accounting Services?

1. Cost Savings

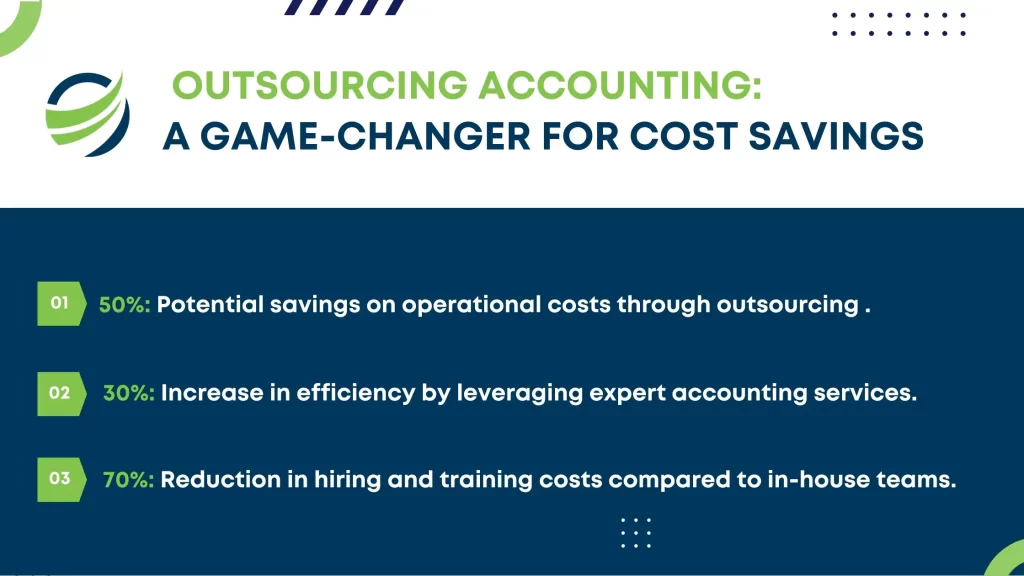

One of the most compelling reasons to outsource accounting services is the potential for substantial cost savings. According to a report, businesses can save up to 50% on operational costs by outsourcing non-core functions like accounting. Learning how to outsource accounting services effectively enables companies to partner with external firms, helping them avoid expenses related to hiring, training, and maintaining an in-house accounting team.

This is particularly beneficial for small and medium-sized enterprises (SMEs) that may not have the budget for full-time staff. For instance, working with a small business accountant offshore can significantly reduce expenses without sacrificing quality.

2. Access to Expertise

Many U.S. accounting firms outsourcing to India have established good partnerships with firms that employ highly qualified accountants and finance professionals who are well-versed in international accounting standards. This expertise is invaluable for tasks such as tax preparation, financial analysis, and compliance reporting.

3. Improved Efficiency

By outsourcing accounting work, businesses can significantly improve their operational efficiency. External firms often utilise advanced technology and streamlined processes that can enhance productivity. For instance, many outsourcing firms use sophisticated accounting software that automates routine tasks, reducing the time spent on manual data entry and allowing for quicker turnaround on financial reports. This can be especially helpful in bookkeeping small business accounting, where automation can save time and reduce errors.

4. Scalability

As businesses grow, their accounting needs may change dramatically. Outsourcing offers the flexibility to scale services up or down based on current requirements without the hassle of hiring or training new employees. For example, a startup may initially need basic bookkeeping services but later require more complex financial analysis as it expands. With Outsource bookkeeping and accounting small business solutions, companies can adjust their services according to their evolving needs.

5. Focus on Core Business Activities

Outsourcing allows business owners and managers to concentrate on their core competencies and strategic initiatives rather than getting bogged down with financial details. This shift in focus can lead to improved business performance and growth opportunities. Whether it’s through a small business accountant offshore partnership or collaborating with outsourcing accounts payable companies, business owners can spend more time growing their businesses while leaving the financial management to professionals.

6. Enhanced Compliance and Risk Management

Professional accounting firms stay updated with the latest regulations and compliance requirements, which helps reduce the risk of errors and penalties associated with tax filings and financial reporting. For instance, according to a survey by the American Institute of CPAs (AICPA), nearly 40% of businesses reported facing compliance challenges due to changing regulations. By choosing to outsource CPA services for startups, businesses can effectively mitigate such risks while ensuring that their financial operations align with current laws and standards.

7. Improved Financial Insights

Outsourced accounting services often include advanced reporting and analytics capabilities that provide businesses with valuable insights into their financial health. This data can inform decision-making processes and help identify trends or areas for improvement. With the help of outsourcing accounts receivable providers, businesses can access detailed financial reports that guide better strategic decisions.

8. Time Zone Advantage

For U.S.based Accounting companies considering outsourcing options like outsource accounting to India, one significant advantage is the time zone difference. Indian firms can work during U.S.-based off-hours, allowing for faster turnaround times on financial reports and other critical documents.

Where to Outsource Accounting Services

When deciding where to outsource accounting services, many U.S. companies look toward countries like India due to its established reputation for providing high-quality services at competitive rates.

Benefits of Outsourcing to India:

- Cost-Effectiveness: The labor costs in India are significantly lower than in the U.S., allowing businesses to save on expenses while still receiving high-quality service.

- Skilled Workforce: India boasts a large pool of qualified accountants who are proficient in various accounting software and practices.

- Cultural Compatibility: Many Indian firms have experience working with U.S.-based clients, making communication smoother and more effective.

- Technological Proficiency: Indian outsourcing firms often utilise the latest technology that enhances service delivery and efficiency.

How Much Does It Cost to Outsource Accounting?

The cost of outsourcing accounting services varies based on several factors:

- Complexity of Services: More complex tasks such as tax preparation or financial analysis will typically incur higher fees compared to basic bookkeeping.

- Volume of Transactions: Higher transaction volumes may lead to increased costs due to the additional work required.

- Provider Location: Costs may differ based on whether the provider is local or offshore (e.g., U.S.-based firms vs. Indian firms).

- Engagement Model: Different pricing structures (hourly rates vs. fixed monthly fees) can also impact overall costs.

While specific figures are not included here, understanding these factors is crucial for businesses when budgeting for outsourced accounting services. Whether businesses need to Outsource bookkeeping and accounting small business or partner with outsourcing accounts payable companies, choosing the right provider is key to managing costs effectively.

FAQs

1. What Types of Accounting Services Can Be Outsourced?

Outsourcing accounting services has become a strategic move for businesses looking to streamline their financial operations. Many companies choose to delegate specific accounting tasks to external providers, allowing them to focus on their core business activities. Below are some commonly outsourced accounting services:

- Bookkeeping

- Payroll processing

- Tax preparation

- Financial reporting

- Audit support

2. Is Outsourcing Safe?

Yes, outsourcing can be safe when partnering with reputable firms that prioritize data security and comply with regulations. It’s crucial to research potential providers thoroughly, ensuring they follow industry best practices for data protection and legal compliance to safeguard your business’s financial information.

3. Can I Maintain Control Over My Finances While Outsourcing?

Yes, you can maintain control over your finances while outsourcing. Regular communication, oversight, and setting clear expectations from the beginning ensure that the outsourcing partner aligns with your business goals and financial needs, giving you confidence in the process.

4. How Do I Choose the Right Outsourcing Partner?

To choose the right outsourcing partner, consider their experience in your industry, reputation, client reviews, and the range of services offered. Also, evaluate their communication practices and security measures to ensure they align with your business needs and safeguard your financial data.

Conclusion

Outsourcing accounting services presents numerous advantages for U.S.-based businesses seeking efficiency and cost-effectiveness in their financial operations. By understanding how to outsource accounting services, including the reasons for doing so, potential locations for providers like India, and cost considerations, companies can make informed decisions that enhance their overall performance.

Additionally, outsourcing bookkeeping small business accounting ensures that even routine financial tasks are handled with precision, allowing businesses to maintain accurate records and focus on growth opportunities.

In a rapidly evolving business environment where every dollar counts, embracing outsourcing not only alleviates financial burdens but also positions businesses for long-term success in an increasingly competitive marketplace. Whether you are a startup looking for affordable solutions or an established company seeking expert insights, outsourcing your accounting needs could be the strategic move that propels your business forward into a prosperous future.

Get in touch with NCS Global today and let us help you streamline your operations! Contact Us.