- May 20, 2025

- by NCS Global

- 5mins read

The accounting world in 2025 looks a lot different than it did just a few years ago. The rise of machine learning, data-driven tools, and intelligent automation has transformed how accounting professionals approach everyday tasks.

If you’re wondering how to use AI in accounting today, whether you’re running a startup, leading a finance team, or managing the books for a small business, this blog unpacks exactly what you need to know.

The Shift: Why 2025 Is a Big Year for Accounting Technology

As we move deeper into the decade, accounting is no longer just about balance sheets and reconciliations, it’s about insights, strategy, and precision. A large number of US-based businesses have now integrated some form of intelligent automation into their finance processes.

According to recent surveys, over 60% of mid-sized firms have upgraded their systems to include artificial intelligence accounting software, while larger enterprises are investing in custom AI models that align with their internal systems.

One of the driving forces is the sheer amount of financial data businesses need to process. Manual work can’t keep up and that’s where smart tools come in. These tools aren’t replacing accountants, they’re offering smarter accounting support, handling repetitive tasks like data entry and invoice matching so professionals can focus on strategic decisions.

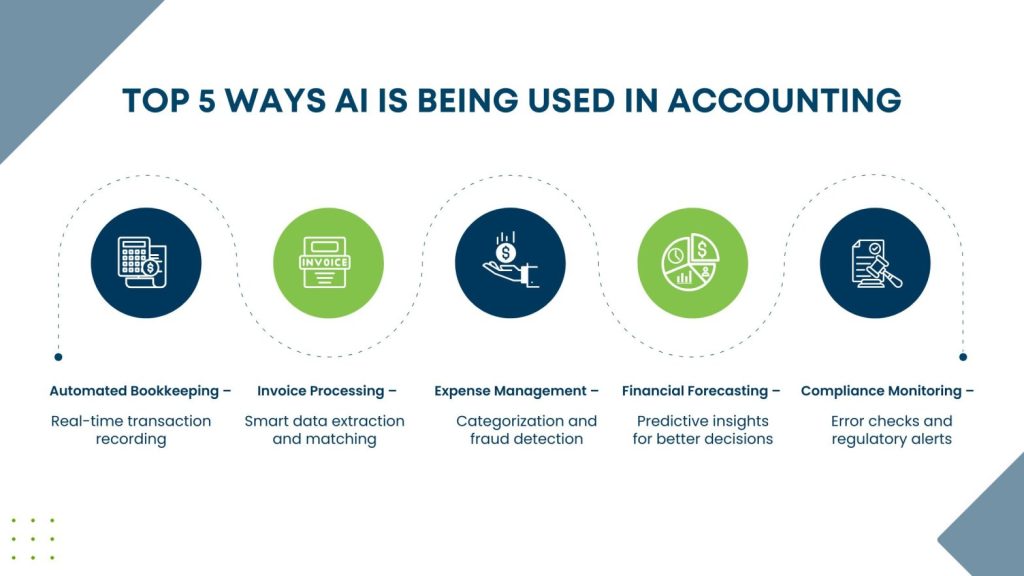

Where It’s Making a Difference: Common Use Cases

Wondering where to start? Here are some of the most impactful examples of AI in accounting that are already being used in 2025:

- Bookkeeping and Data Entry:

Smart tools automatically categorise transactions, update ledgers, and even suggest corrections. - Accounts Payable/Receivable:

AI matches invoices, identifies discrepancies, and even schedules payments. - Tax Preparation:

Instead of spending hours combing through documents, tools now help generate accurate filings by pulling data from multiple sources. - Financial Reporting:

Real-time dashboards provide clear financial snapshots, projections, and risk insights. - Fraud Detection:

With pattern recognition, anomalies are flagged instantly something traditional audits often miss.

These are not future goals; they’re current capabilities being used every day by businesses across the US.

The Benefits Go Beyond Time-Saving

Implementing AI for finance and accounting doesn’t just save time. Here are some of the real-world advantages companies are experiencing:

- Fewer Errors:

Smart systems learn from corrections and help reduce manual mistakes. - Better Decision Making:

Data insights give CFOs and founders a clearer understanding of cash flow, profitability, and risk. - Cost Reduction:

While there’s an initial investment, long-term savings in salaries, compliance penalties, and missed opportunities are significant. Combined with financial services outsourcing, AI gives firms the agility to access top-tier expertise while reducing overhead, especially valuable for startups and lean teams looking to scale without inflating their in-house payroll. - Scalability:

Businesses can grow without having to double the size of their finance departments.

There’s a clear business case forming. Firms that are early adopters of AI for finance and accounting are seeing stronger productivity and more meaningful client engagement. According to Karbon’s 2025 State of AI in Accounting Report, firms that strategically integrate AI into their operations are gaining a competitive edge by enhancing productivity and delivering greater value to clients. It’s no longer about staying current, it’s about staying ahead.

What’s Trending in 2025: What’s New and What’s Next

So, what’s different this year? A few standout trends:

- Real-Time Syncing:

Instead of month-end crunches, smart systems update books continuously. - Natural Language Interfaces:

You can now ask questions like, “What were our Q1 expenses on SaaS tools?” and get a response from your system, no filter or pivot tables needed. - Integration with Other Tools:

CRM, payroll, ERP, modern accounting systems are designed to plug in seamlessly. - Privacy-Focused Features:

With increased scrutiny from regulators, especially in the US, security and transparency are front and center.

And perhaps one of the biggest changes?

A growing number of businesses are no longer treating AI as an experiment they’re embedding it into core financial functions. A recent KPMG survey reveals that 62% of U.S. companies are utilizing AI in their finance functions to a moderate or large extent, with 52% specifically applying AI in financial reporting. This signals a broader shift: AI is no longer just an efficiency tool; it’s becoming central to how financial decisions are made and reports are generated.

The Best AI Tools for Accounting in 2025

Now that you understand where things are heading, let’s look at some of the best AI tools for accounting currently in use:

- Vic.ai: Helps automate invoice processing and improves accuracy in accounts payable.

- Botkeeper: Supports CPA firms by automating bookkeeping, reducing the need for manual entries.

- Docyt: Offers real-time financial visibility and helps with multi-location business reporting.

- MindBridge: Known for its anomaly detection, especially useful during audits.

- QuickBooks AI: The classic tool now comes with upgraded smart features that help with forecasting and transaction sorting.

- Xero Add-Ons: Includes machine-learning integrations that learn your business’s habits and predict financial trends.

These tools aren’t just about automation, they’re about giving accountants better, faster access to insights.

Challenges to Be Aware Of

Of course, no system is perfect. Here are a few common concerns businesses encounter when implementing artificial intelligence accounting software:

- Cost of Implementation:

Initial setup, migration, and training can be expensive. - Skill Gap:

Not every accountant is familiar with modern tools. Training takes time and effort. - Compliance Risks:

Incorrect configuration or misused tools can cause compliance headaches. - Data Privacy:

Sensitive financial information requires strict controls. Ensure the software complies with regulations like SOX and HIPAA.

The good news? Most of these challenges can be mitigated with good planning and the right vendor.

Who Should Use It?

If you think only big companies benefit from these tools, think again. The real winners of this shift are:

- Startups looking to stay lean without compromising financial control

- Small businesses tired of spreadsheet-based bookkeeping

- Mid-sized firms scaling operations across states or verticals

- Accounting firms that want to serve more clients with smaller teams

The playing field is getting more level and the right tools can make a big difference.

Will It Replace Accountants?

This question still comes up a lot. And the answer remains: No, but it is changing what accountants do.

Rather than spending hours reconciling accounts or entering receipts, professionals are now focusing on strategic financial planning, scenario forecasting, and advisory services. In fact, many accounting pros say they feel more valuable to clients and their companies thanks to the time saved by automation.

Closing Thoughts

Understanding how to use AI in accounting isn’t about chasing trends, it’s about staying prepared, working smarter, and giving your business the tools it needs to succeed.

The landscape of finance and accounting is evolving rapidly, especially in the US. Whether you’re a solo bookkeeper, part of a large finance department, or running a growing business, investing in the right tools today can give you a major edge tomorrow. Whether firms choose to invest in internal tools or lean into outsourcing, the key will be balancing automation with real-time insights, making financial data more accessible, actionable, and timely than ever.

Explore, test, ask questions, and embrace the future of accounting on your terms.