- May 23, 2025

- by NCS Global

- 7mins read

A few years ago, accounting was all about ledgers, spreadsheets, and long hours of data entry. Fast forward to 2025, and the landscape looks very different. New tools are not only saving time but also changing how accountants work, think, and deliver value.

This transformation has also led to a rise in accounting outsourcing, where companies rely on external experts and platforms to manage routine processes while focusing on strategy. The shift is no longer limited to automation; it’s about insight, agility, and better decision-making.

So, what exactly is reshaping the way we look at accounting in 2025? Let’s explore the most important accounting technology trends 2025 that are defining the future of the finance industry.

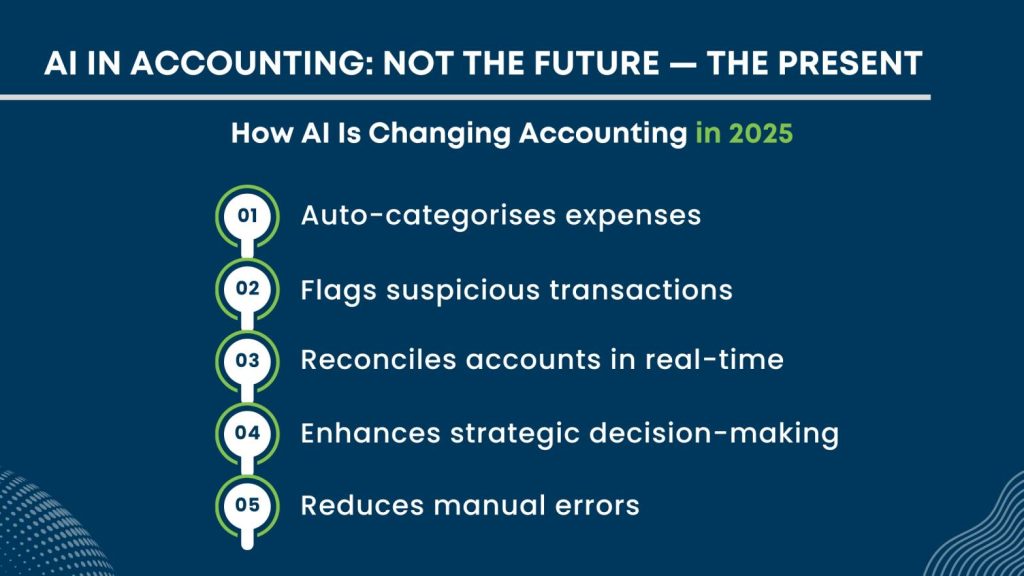

AI Is Quietly Redefining Efficiency

Artificial intelligence is not about robots replacing accountants; it’s about giving finance professionals more clarity, speed, and control. From categorising expenses to flagging suspicious transactions, many day-to-day tasks are now being handled by intelligent systems. If you’re curious about how this is playing out specifically in the U.S.

What’s notable in 2025 is how naturally AI has blended into everyday accounting software. It’s become less of a “feature” and more of a built-in ability. Accountants no longer need to spend hours reconciling bank statements or checking for minor errors; those tasks are often completed automatically, with just a final review needed.

For firms handling large volumes of transactions, this means fewer errors, quicker reports, and more room to focus on strategic work like budgeting or forecasting.

As highlighted by Better Accounting, this shift is prompting a redefinition of roles, accountants are moving away from repetitive tasks toward strategic problem-solving and cross-functional collaboration. AI isn’t replacing professionals; it’s repositioning them as business advisors.

Cloud-Based Systems Are 2025’s New Standards

A few years ago, cloud accounting was gaining ground. Today, it’s expected.

According to a 2025 report by Accounting Insights, cloud-based accounting platforms are now considered essential for offering real-time data access and enabling improved collaboration among stakeholders. These solutions help reduce IT overhead and support hybrid work environments by connecting seamlessly with CRMs, payroll systems, and payment gateways.

Cloud platforms are now the core of most accounting technology stacks. They allow businesses to access their financial data anywhere, anytime; no more being tied to a desktop or waiting to access a file.

But the real value in 2025 lies in how these systems connect with other tools. Whether it’s a CRM, payroll software, or even your payment gateway, integration is smoother than ever. Real-time syncing means fewer delays and better accuracy across departments.

This has become especially important for businesses with hybrid or remote teams, as everyone from the CFO to the outsourced bookkeeper can collaborate on the same dashboard in real-time.

Data Visualisation Is Giving Accountants a Bigger Voice

In 2025, numbers alone don’t tell the full story; clear, visual insights do.

One of the biggest technology trends for accountants this year is the growing use of dashboards and visual reports. Instead of static spreadsheets, business owners now rely on graphs, charts, and real-time KPIs to understand what’s really happening in their business.

This shift gives accountants a more strategic role. Rather than only reporting the numbers, they’re now helping to interpret them, explain trends, and guide decision-making.

Tools that connect directly to accounting software and present insights in digestible formats are helping even non-finance stakeholders understand business health at a glance.

Blockchain: Still Evolving, but Already Making a Mark

Blockchain might not be everywhere yet, but in 2025, it’s found solid ground in areas like auditing, contracts, and transaction validation.

Its strength lies in transparency and traceability. When used in accounting, it ensures that records can’t be tampered with, making audits faster and more trustworthy. Some businesses are already using smart contracts to automate payments and compliance.

While it may still be evolving, the future of blockchain in accounting seems promising, especially in industries that deal with complex compliance or high-volume transactions.

Sustainability Reporting Tools Are No Longer Optional

With increasing attention on environmental and social impact, digital transformation in accounting is now extending to ESG (Environmental, Social, and Governance) reporting.

Businesses are expected to measure, report, and act on their carbon footprint, resource usage, and ethical practices. This means finance teams need tools that can track non-financial metrics and include them in regular reporting cycles.

Software providers have stepped up, offering modules that collect ESG data and link it to financial performance. This is turning ESG from a tick-box exercise into a strategic advantage.

Cybersecurity in Finance Is Getting Smarter

As more financial data moves online, the threat of cyberattacks increases. That’s why modern accounting tools now come with advanced security features such as two-factor authentication, encryption, role-based access, and more.

In 2025, businesses are more cautious about who can access what. Finance platforms now allow companies to create detailed user roles, limiting exposure and ensuring compliance.

Cybersecurity audits are also becoming a part of regular financial check-ins, helping businesses maintain trust and meet regulatory obligations.

The Human Side of Accounting Is Being Reskilled

With automation taking over the repetitive parts of the job, what’s left for accountants? A lot, actually.

Soft skills, adaptability, and analytical thinking are now key. In fact, firms are investing more in training their teams to use new tools, explain insights, and communicate financial implications clearly to business leaders.

A well-known example is IKEA, which reskilled 8,500 customer support staff as virtual design experts after AI took over much of the service function. Accounting teams are going through a similar shift; becoming advisors, analysts, and interpreters of financial health, rather than number crunchers.

Fintech Integration Is Creating Smarter Workflows

Modern finance is more connected than ever. From payment apps to e-commerce platforms, fintech tools are everywhere, and they’re becoming part of the accounting technology stack.

The integration between fintech apps and accounting software is helping businesses get a more complete picture of their cash flow, customer behaviour, and financial health.

According to a 2025 article by Invensis, this level of integration provides deeper insights and significantly enhances operational decision-making. For many small businesses, it means access to enterprise-level intelligence without the cost of enterprise software.

This level of integration also supports real-time decision-making, smoother customer experiences, and faster financial closure.

Finance and Accounting Outsourcing Trends in 2025

Outsourcing isn’t new, but the way it’s being done has evolved.

Instead of handing over all functions to a third-party firm, businesses now collaborate with virtual accounting teams that work as an extension of their own staff. Outsourced providers now use the same cloud tools and real-time dashboards, making the relationship more transparent and collaborative.

This trend has grown especially among startups and SMEs that want expert help without hiring in-house. As finance and accounting outsourcing trends mature, the focus is shifting from just cost savings to value creation, bringing in specialists to guide strategy, ensure compliance, and support scaling.

The Road Ahead: What This Means for Businesses

In 2025, the future of the accounting industry is less about tools and more about mindset. Businesses that embrace change, not just for the sake of being modern, but to improve how they make decisions, will lead the way.

For accountants, this means less time spent on manual entries and more time understanding what the numbers mean. For business owners, it means more clarity, faster answers, and a closer connection between money and growth.

Whether you’re an SME looking to improve efficiency or a large firm focused on compliance and forecasting, adopting the right technology will give you a real edge.

Conclusion

From automation and cloud platforms to blockchain and ESG reporting, the accounting technology trends 2025 are pushing the finance world into a smarter, faster, and more connected era.

Change can feel overwhelming. Whether you’re an SME looking to improve efficiency or a large firm focused on compliance and forecasting, adopting the right tools, and even exploring financial services outsourcing can give your business a real edge.

But the good news? You don’t need to master every new tool. Start by understanding your business needs, exploring tools that meet those needs, and building a finance function that doesn’t just support growth, but helps drive it.

FAQ

1. How is AI transforming accounting practices in 2025?

AI is transforming accounting by automating tasks like data entry and reconciliations, reducing errors, and saving time. It offers predictive insights, letting accountants shift from routine work to advisory and strategic roles, adding more value to businesses.

2. What role does cloud accounting play in modern finance?

Cloud accounting provides real-time financial data access from anywhere, improving collaboration among teams and stakeholders. It supports integration with payroll, banking, and tax systems, making operations more efficient and decision-making faster.

3. How does blockchain enhance security in accounting?

Blockchain boosts accounting security by creating tamper-proof, transparent ledgers. Every transaction is traceable, reducing fraud and making audits easier. It also ensures compliance by providing real-time access to validated and trustworthy financial records.

4. What are the challenges of adopting new accounting technologies?

Adopting new accounting tech brings challenges like high setup costs, integration with old systems, and staff resistance. Training is vital, and firms must address cybersecurity risks while adapting workflows to use AI, blockchain, and cloud tools effectively.