- July 8, 2025

- by NCS Global

- 6mins read

Paying taxes is a civic duty, but that doesn’t mean you shouldn’t explore smart, legal ways to reduce what you owe. While federal income taxes fund essential services like infrastructure, education, and defense, many Americans still find themselves wondering how to reduce taxable income without crossing any lines.

The good news? There are legitimate income tax reduction strategies available for individuals and businesses alike. From claiming all eligible deductions to optimizing retirement contributions and charitable giving, these proven methods can significantly lower your taxable income. In this guide, NCS Global outlines 11 effective ways to reduce taxable income in the U.S. for 2025, so you can save more, stress less, and stay compliant.

What Is a Tax Deduction?

A tax deduction is a qualified expense that you incur for work or income-related purposes. When you claim a tax deduction on your federal tax return, it helps lower your taxable income, which in turn reduces the total amount of tax you owe to the IRS.

Think of it this way: the lower your taxable income, the more money you get to keep, whether it’s to invest, save, or spend on what matters most to you. Understanding what qualifies as a deductible expense is one of the smartest tax minimisation strategies for 2025.

To be eligible, most deductible expenses in the U.S. must meet three basic criteria:

- You must have paid for the expense yourself (not reimbursed).

- The expense must have a direct connection to the income you earn.

- You must keep accurate records, such as receipts or invoices, to support your claim.

If you’re wondering how to save on tax in U.S., claiming all eligible deductions is one of the most effective and legal paths to explore. And for many Americans, working with a certified tax professional or using a trusted e-filing service ensures that no opportunity is missed.

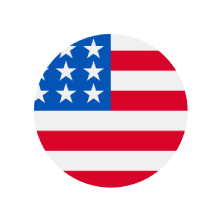

What Is Your Taxable Income?

Taxable income is the total income the IRS considers when calculating how much tax you owe after applying deductions and credits.

This includes:

- Wages and salaries (W-2)

- Social Security and pension income

- Interest and dividends

- Business or freelance income

- Rental income

- Capital gains

- Certain government benefits

Knowing what’s taxable helps you apply the right income tax reduction strategies and identify legal ways to reduce taxable income in 2025.

1. Claim Every Eligible Deduction

Claiming tax deductions is one of the most effective ways to reduce taxable income. Expenses related to earning your income such as professional fees, home office use, mileage, or tools can be deducted, even if used partially for work. Every small claim adds up.

Keep accurate records like receipts and logs to support your claims. Using expert guidance or advanced tax software can help identify overlooked deductions and boost your refund potential.

2. Make Charitable Contributions

Donations to IRS-qualified charities can reduce your taxable income. Whether you’re giving money, goods, or appreciated assets, these gifts are deductible if you retain proper documentation like receipts or acknowledgment letters.

You may benefit by combining multiple years’ donations into one tax year to surpass the standard deduction threshold.

3. Contribute to Tax-Advantaged Accounts

Contributing to a 401(k), IRA, or HSA lets you defer taxes while building future financial security. In 2025, you can contribute up to $23,500 to your 401(k), and HSA limits reach $8,550 for families.

These accounts reduce your taxable income now while offering tax-free growth or withdrawals later. If you’re looking for how to lower your taxable income in 2025, contributing to a 401(k), IRA, or HSA is one of the most effective and widely recommended options.

4. Utilize Flexible Spending Accounts (FSAs)

Flexible Spending Accounts let you contribute pre-tax dollars for qualified medical or dependent care expenses. This reduces your taxable income upfront and helps you cover everyday costs tax-free.

In 2025, the FSA contribution limit is expected to be around $3,200. Make sure to use the full balance before year-end, as FSAs often follow a “use it or lose it” rule.

5. Bundle Itemized Deductions

If your itemized deductions (like mortgage interest, state taxes, or medical expenses) come close to the standard deduction, consider bunching two years’ worth of expenses into one. This could help you exceed the threshold and lower your tax liability.

Strategic timing like paying medical bills or charitable donations all in one year can maximize your deductions and reduce taxable income more than spreading them out.

6. Defer or Time Your Income

If you’re self-employed or expecting a year-end bonus, you may be able to defer income into the next calendar year. This can keep you in a lower tax bracket and reduce your 2025 tax bill.

Similarly, delay invoicing or negotiate payment timing where possible. Shifting income between years is a smart and fully legal way to manage tax burdens.

7. Optimize Capital Gains

Selling investments held over 12 months qualifies you for lower long-term capital gains tax rates 0%, 15%, or 20%, depending on your income level. This rate is much lower than the tax applied to short-term capital gains, which are taxed as ordinary income.

When possible, hold onto investments until you pass that 12-month mark. Doing so can substantially reduce the amount you pay in taxes on appreciated assets.

8. Harvest Tax Losses

Capital losses can be used to balance out gains and lower your taxable income by as much as $3,000 per year. Known as tax-loss harvesting, this is a useful strategy to cushion your tax bill during volatile markets.

After harvesting losses, you can reinvest in similar (but not identical) assets to maintain your portfolio strategy without violating the IRS’s wash-sale rules.

9. Keep Meticulous Records

Proper documentation is key to claiming eligible deductions and ensuring smooth interactions with the IRS. Save receipts, invoices, mileage logs, and bank statements to support your tax return.

Many taxpayers overpay simply due to poor documentation. Use apps or cloud storage to track expenses throughout the year and stay audit-ready.

10. Consult a Tax Professional

Tax professionals are trained to uncover credits and deductions that may not be obvious to you. They can help you structure your finances to reduce taxable income efficiently and stay compliant with ever-changing IRS rules.

Best of all, their fees are tax-deductible if you’re filing for business or rental income. It’s a smart investment in both peace of mind and bottom-line savings.

11. Use Tax Software or AI Tools

Modern tax software and AI-powered apps can scan your bank transactions and automatically detect missed deductions. This helps you find savings even if you forgot to keep physical receipts.

Some tools also identify expenses that don’t require receipts like standard mileage or home office use. Using tech is a modern, hands-free way to support your income tax reduction strategies.

Conclusion: Take Control of Your Tax Strategy in 2025

Reducing your tax bill doesn’t require loopholes or risky tactics, it starts with knowledge, tax planning, and a proactive approach. By understanding your income sources, leveraging eligible deductions, and implementing smart strategies like retirement contributions, charitable giving, and tax-loss harvesting, you can effectively take charge of your financial future.

As you look ahead to 2025, remember that the key to long-term savings is knowing how to reduce taxable income in ways that are both legal and strategic.

From maximizing deductions to exploring ways to reduce taxable income through timing and structure, these proven tips can help you lower your tax liability, increase your refund, and build lasting financial confidence. Don’t wait for tax season to start planning today.