- July 24, 2025

- by NCS Global

- 5mins read

The One Big Beautiful Bill Act, enacted on July 4, 2025, has significantly altered American fiscal policy. For Canadian CPAs and accountants managing cross-border clients, grasping the new 2025 tax provisions is crucial. This comprehensive guide details every major change, and provides authoritative data.

Key Takeaways

- Permanently extends individual rate cuts first introduced under the TCJA Act while narrowing the gap between the highest and lowest brackets.

- Temporarily raises the SALT deduction cap to $40,000 for 2025-2029, phasing it out for MAGI above $500,000, before snapping back to $10,000 in 2030.

- Creates two unprecedented worker deductions, tips and overtime, capped at $25,000 each and available through 2028. To learn how NCS Global can help manage these changes, explore our Tax Services for cross border professionals.

- Lifts the standard deduction to $15,750 single / $31,500 joint for 2025 and locks in permanent inflation indexing thereafter. Nearly 90% of filers are expected to claim it, preserving the simplicity that taxpayers embraced after 2017.

- Makes 100% bonus depreciation and immediate domestic R&D expensing permanent, encouraging capital investment on U.S. soil.

- The plan is projected to add between $3.0 trillion and $3.4 trillion to the deficit from 2025 to 2034. However, it is also projected to boost long term GDP by 1.1% to 1.2%.

Why Canadian CPAs Must Act Now

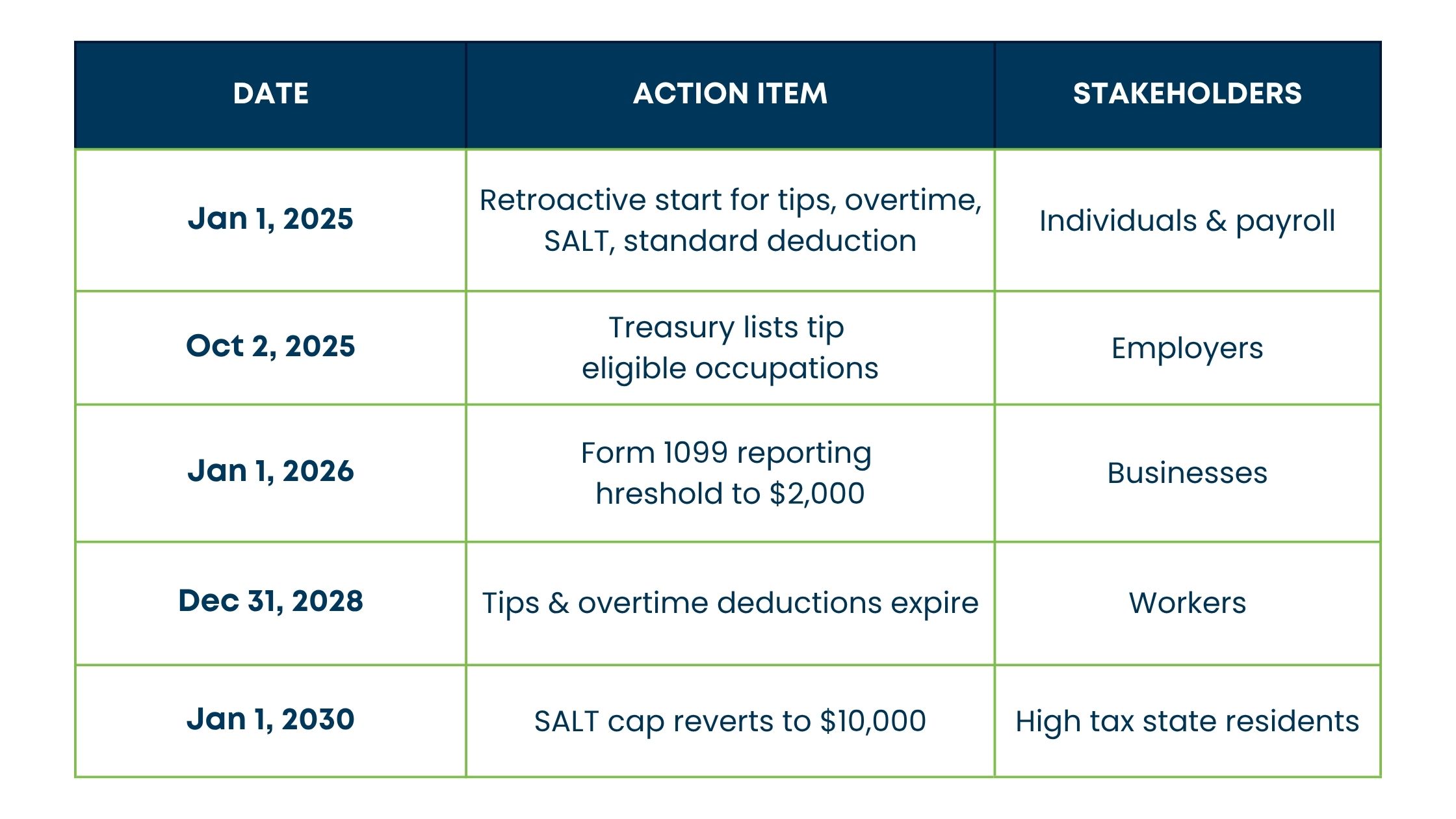

Cross border taxpayers face a compressed timeline: many provisions are retroactive to January 1, 2025, and others sunset as early as 2028. Not aligning Canadian and U.S. filings properly could lead to double taxation or missed deductions. The following pages equip you with both the macro view and granular action steps.

Permanent Extensions of TCJA Individual Provisions

Locking In Rate Certainty

The TCJA Act trumps individual brackets that remain at 10%, 12%, 22%, 24%, 32%, 35%, and 37% through 2034. Permanency converts year to year guesswork into decade long planning clarity.

Standard Deduction Surge

For 2025 returns, the federal standard deduction rises to $15,750 single / $31,500 joint, an extra $750 and $1,500 respectively over 2024. The additional 65 plus “senior bonus” tacks on another $6,000 through 2028.

Because nearly 90% of filers already opt for the standard deduction, Canadian advisors should revisit U.S. housing and mortgage strategies for expatriate clients who formerly relied on itemising.

Revolutionary Worker Deductions

No Tax on Tips Deduction

- Eligible Workers: Occupations “customarily and regularly” receiving tips (Treasury list due Oct 2, 2025).

- Cap: $25,000 per filer.

- Payroll Note: FICA taxes still apply.

Overtime Premium Deduction

- Deduction equals the 50% premium portion of time and a half pay, capped at $12,500 single / $25,000 joint.

- Phaseouts start when Modified Adjusted Gross Income (MAGI) reaches $150,000 for single filers and $300,000 for joint filers.

For restaurants, hotels, and logistics firms with Canadian ownership but U.S. payrolls, immediate payroll system patches are essential to track deductible vs. FICA taxable amounts.

SALT Cap Reset: Five Year Golden Window

The SALT tax provision introduces a $40,000 cap from 2025-2029, indexed at 1% annually, reverting to $10,000 in 2030. Phaseout starts at 30% of income over $500,000, limiting high earners to a maximum deduction of $10,000. Effective marginal rates may exceed 45% for incomes between $500k and $600k.

| Provision | 2025 Amount | Sunset | Key Audience | Benefit Mechanism |

|---|---|---|---|---|

| Child Tax Credit | $2,200 per child | Permanent | Families | Dollar for dollar credit |

| Senior Bonus Deduction | $6,000 per taxpayer 65+ | 2028 | Older adults | Above the line deduction |

| Trump Accounts | $5,000 annual child IRA cap + $1,000 opening credit | 2034 funding | Parents of minors | Tax deferred growth |

Business Provisions That Reshape Capital Allocation

- 100% Bonus Depreciation—Permanent: Accelerates after tax ROI on equipment and certain structures.

- Domestic R&D Expensing—Permanent (retroactive to 2022 small businesses): Eliminates the five year amortisation drag.

- Section 179 Deduction Increase: The deduction limit rises to $2.5 million, with a phaseout starting at $4 million.

- 2024 Senate Bill on Form 1099-MISC: The reporting threshold will increase from $600 to $2,000 in 2026, with adjustments for inflation thereafter.

Canadian subsidiaries operating in the U.S. should revisit transfer pricing studies as accelerated depreciation shifts taxable income timing.

International Rules: GILTI, FDII, BEAT Rewired

- Section 250 deduction trimmed to 40% for both net CFC tested income (GILTI) and foreign derived income, equalising effective rates near 14%.

- BEAT rises to 10.5%; watch for impact on intercompany service charges.

- The deemed paid credit for Subpart F inclusions is raised to 90%, helping to reduce the impact of double taxation.

Cross border holding companies need fresh E&P analyses to optimise dividend repatriation pre-2030.

| Metric | 10 Year Change | Source |

|---|---|---|

| Federal revenue loss, conventional | −$5.0 trillion | Tax Foundation |

| Revenue loss, dynamic | −$4.1 trillion | Tax Foundation |

| Deficit increase incl. interest | +$3.8 trillion | Tax Foundation |

| Long run GDP | +1.2% | Tax Foundation |

| Jobs preserved vs. TCJA sunset | 4.1 million | White House |

Compliance Timeline

Practice Ready Strategies for Canadian CPAs

1. SALT Harvesting

Advise clients with multi state holdings to bunch property tax payments into 2025-2029. Model Canadian foreign tax credit interactions to avoid duplication.

2. Payroll Re-Engineering

Embed new deduction codes in U.S. payroll modules; failure to separate taxable and deductible tips could trigger IRS penalties.

3. Capital Expenditure Acceleration

Leverage permanent bonus depreciation by front loading U.S. equipment purchases, then repatriate profits to Canada at lower effective rates under revamped GILTI rules.

4. Estate Recalibration

The $15 million per person exemption invites cross border dynasty trust restructuring before potential policy reversals.

Mid Content Pulse Check

At this midpoint, remember the tax provisions 2025 because every planning tactic hinges on these fresh rules. Embed it in client memos, SEO snippets, and boardroom decks to anchor strategic conversations.

Emerging Risks & Watchpoints

- Regulatory Guidance Gaps: Treasury regulations on tip occupations and overtime qualification could narrow eligibility, stay alert.

- State Conformity Puzzle: Provinces may not match U.S. depreciation schedules; adjust Canadian CCA claims accordingly.

- Debt Overhang: A 9.6 percentage point rise in debt to GDP by 2034 could spur future tax hikes; stress test long term projections.

Conclusion: Seizing the Cross Border Advantage

The One Big Beautiful Bill Act presents a valuable opportunity for advisors knowledgeable in CRA and IRS regulations to enhance client growth. By integrating tax provisions from 2025 into various engagements such as restructuring Delaware LPs, optimising R&D spending for Vancouver parent companies, or assisting retirees.

Remember to quote key stats: nearly 90% of U.S. filers will ride the expanded standard deduction; the SALT window offers up to $30,000 extra deductions per year; and the Act’s dynamic GDP lift of 1.2% could buoy cross border trade flows.

One final nod to search relevance: Trump’s proposed tax bill in 2025 is now law, reshaping compliance. Those who master its nuances today will lead the advisory market tomorrow. If you’re looking to implement these changes effectively, working with experts who specialise in cross border tax issues could significantly enhance your strategy.