- November 29, 2024

- by NCS Global

- 5mins read

Delayed Tax Filing: Are They Linked to the Accountant Shortage?

The recent October 15 tax deadline brought with it a wave of last-minute filings, exposing a growing issue within the financial industry—delayed tax filings and their connection to the accountant shortage. As businesses nationwide scrambled to meet the deadline, it became clear that the root cause of these delays might not just be complex tax requirements but also an underlying shortage of skilled accountants. This shortage, coupled with increasing demand, is creating ripple effects that could impact tax compliance and financial stability for years to come.

Understanding the Accountant Shortage:

In recent years, the accounting profession has encountered a notable shortage of qualified individuals. The American Institute of CPAs (AICPA) indicates that there are nearly 75,000 accountants fewer than what is required to address the increasing demand. This shortfall is linked to several factors, including an aging workforce, a lack of enthusiasm for accounting careers among younger generations, and the heightened complexity of tax regulations that call for more specialised knowledge.

NASBA’s Perspective on Delayed Tax Filings and the Accountant Shortage:

The National Association of State Boards of Accountancy (NASBA) has highlighted the challenges posed by the accountant shortage. Many states are experiencing a decline in the number of new CPAs entering the profession, exacerbating existing workforce challenges. NASBA emphasises the need for educational institutions to adapt their curricula to better prepare students for the realities of the profession and attract new talent to the field.

Challenges and Mitigation Efforts Related to Delayed Tax Filings:

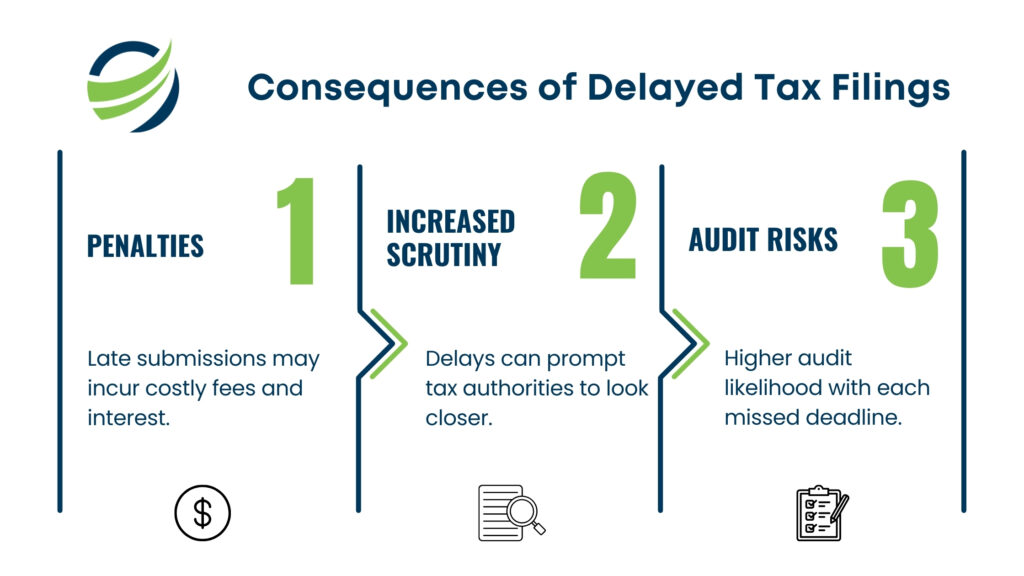

The accountant shortage presents numerous challenges for businesses and the overall economy. Delayed tax filings, compliance issues, and increased operational costs can hinder a company’s growth and stability. To mitigate these challenges, many organisations are exploring creative solutions, such as investing in training programs for existing staff, promoting flexible work arrangements to attract new talent, and fostering a culture of professional development.

How Offshore Virtual Accountants Can Help Reduce Delayed Tax Filings Amid the Accountant Shortage:

In response to the accountant shortage, businesses are increasingly turning to offshore virtual accountants. These professionals can help manage financial responsibilities efficiently while providing high-quality services at a lower cost. Offshore virtual accountants are well-equipped to handle various tasks, including tax preparation, bookkeeping, and financial analysis. By leveraging this resource, companies can alleviate the strain on their in-house accounting teams, ensuring timely filings and accurate financial management without sacrificing quality.

NCS Global: Your Solution for Delayed Tax Filing Challenges During the Accountant Shortage:

At NCS Global, we understand the unique challenges faced by USA CPAs and accountants. Our comprehensive suite of accounting services is designed to support your business in overcoming the obstacles posed by the accountant shortage.

We offer specialised solutions customised for small to mid-sized firms, allowing you to focus on your core competencies while we manage the intricacies of tax preparation and financial reporting to avoid delayed filings. Our offshore virtual accountants are highly skilled and experienced, ensuring that your financial responsibilities are handled with the utmost precision and care.

The Future of Accounting in Light of the Accountant Shortage and Delayed Tax Filings:

The CPA shortage has significant implications for the future of the accounting profession. As businesses increasingly rely on technology and automation, the role of accountants is evolving from traditional bookkeeping to more strategic advisory positions. This shift means that firms must adapt their strategies to attract and retain talent in a competitive market. Furthermore, the profession may need to rethink its approach to training and professional development to ensure that future accountants are equipped with the skills needed to thrive in this changing landscape.

The Impact of the Shortage on Delayed Tax Filing Rates:

The shortage has led to longer wait times for tax services.

The IRS reported that over 24 million Americans filed their taxes late last year, and this trend is expected to continue. Small businesses, which often rely on a limited number of accountants, are feeling the strain the most.

Trends in Delayed Tax Filings:

Recent surveys indicate a marked increase in the percentage of late tax filings, particularly among small businesses. A study by QuickBooks found that 60% of small business owners admitted to filing their taxes late at least once in the past three years. This statistic raises questions about the efficiency of the current accounting workforce and its capacity to meet the rising demands of the industry.

Solutions for Managing Delayed Tax Filings: Outsourcing and Technology:

To combat this growing issue, businesses should consider alternative solutions. Outsourcing accounting functions to firms specialising in tax preparation can alleviate the burden on in-house staff and ensure timely filings. At NCS Global, we offer comprehensive tax services tailored to the specific needs of CPA firms, allowing you to focus on your core operations while maintaining compliance with tax regulations.

In addition to outsourcing, leveraging technology can enhance efficiency in tax preparation. Artificial Intelligence (AI) and cloud-based accounting solutions can streamline data collection, reduce errors, and expedite the filing process. As more firms adopt these technologies, the pressure on accountants may lessen, allowing them to focus on more strategic tasks rather than routine data entry.

Conclusion: Proactively Addressing Delayed Tax Filings Due to the Accountant Shortage:

The connection between the accountant shortage and delayed tax filings is becoming increasingly evident. As the landscape of the accounting profession continues to evolve, businesses must adapt to these changes by exploring innovative solutions that address their unique challenges.

As we approach the tax deadline, it’s crucial for CPA firms to proactively seek out resources and strategies to ensure timely filings. By partnering with NCS Global and embracing outsourcing and technological advancements, you can navigate the complexities of tax compliance and mitigate the impact of the ongoing accountant shortage.

In an industry where time is money, ensuring that tax filings are completed accurately and on time is paramount. The challenges posed by the accountant shortage may be significant, but with the right approach and support from NCS Global, businesses can turn these challenges into opportunities for growth and efficiency.