- October 11, 2024

- by NCS Global

- 5mins read

Form 1040 Demystified: Elevating CPA Expertise for 2024

Form 1040 is perhaps the most important tax form for individual filers in the United States, yet it can still be challenging, even for seasoned CPAs. Each year, countless changes in tax laws, regulations, and client circumstances bring complexities. But as a CPA, your ultimate goal is to provide the best service for your clients and ensure they get the maximum benefit.

What is Form 1040?

Form 1040 is the individual income tax return form that U.S. taxpayers use to report their annual income to the IRS. It is the foundation for all other tax reporting and requires an accurate summary of taxable income, deductions, credits, and the resulting tax liability. This form is critical for your clients because it impacts everything from refunds to audit risks.

Why Form 1040 Remains a Challenge for CPAs –

Despite its long history, Form 1040 remains challenging due to a few reasons:

- Frequent Changes in Tax Laws: The tax code is dynamic, with yearly updates such as changes in deductions, brackets, and credits, making it challenging for CPAs to stay current and apply these changes effectively for clients.

- Complex Client Situations: With the growth of the economy and diverse income sources, CPAs face more complex situations, making Form 1040 preparation more time-consuming.

- Documentation and Compliance Burden: Gathering documents from clients is challenging, as they often lack preparedness or fail to provide all necessary documentation, leading to delays and potential penalties.

Key Updates on IRS Form 1040 for 2024 US CPAs Must Know:

As we approach the 2024 tax season, there are several key updates to IRS Form 1040 that USA CPAs should be aware of:

- Increased Standard Deductions: The standard deduction for 2024 has been raised. For single filers, it’s now $14,600, while married couples filing jointly can claim $29,200. This change can significantly impact your clients’ taxable income and overall tax liability.

- Changes in Tax Rates: The IRS has adjusted tax brackets for inflation, which may affect how much tax your clients owe. It’s essential to review these changes and how they may impact various income levels.

- New Tax Credits: There are new tax credits available for certain individuals and families, especially aimed at promoting clean energy and supporting education. Make sure you’re familiar with these credits to maximise client benefits.

How to Maximise Tax Deductions with Form 1040:

To ensure your clients are taking full advantage of tax deductions, here are some strategies specific to California residents:

Itemised Deductions: Encourage clients to itemise deductions if they exceed the standard deduction. Common deductions are state income taxes, mortgage interest, and property taxes. In California’s high cost of living, many taxpayers may find itemisation more beneficial.

Deductions for Home Office: With remote work increasing, Californians may qualify for the home office deduction. It’s important to help clients understand the requirements and accurately calculate this deduction.

Investment-Related Deductions: Remind clients about deductible investment expenses, such as investment management fees, particularly for those with large portfolios.

Health Care Deductions: Californians can also take advantage of deductions for medical expenses. If clients incur substantial medical costs, it’s wise to recommend that they carefully track these expenses for possible deductions.

Maximise Charitable Contributions: With new cash donation limits, help clients maximise their charitable contributions and fully utilise available deductions.

NCS Global: Your Partner in Tackling the Challenges of Form 1040

NCS Global recognises the challenges CPAs encounter and aims to support them in delivering quality client service. Let’s explore the pain points for CPAs and how NCS Global can streamline the process.

1. Keeping Up with Changing Tax Regulations

Navigating the changing tax preparation can be challenging, especially for CPAs with multiple clients. NCS Global offers a team of tax professionals who stay updated on regulations and best practices, allowing CPAs to leverage our expertise, reduce their workload, and minimise errors.

Statistically, over 40% of CPAs cite keeping up with tax law changes as one of the biggest challenges in their profession.

2. Handling Complex Client Scenarios

From capital gains, foreign tax credits, self-employment income, to more intricate scenarios, clients’ tax situations are becoming increasingly convoluted. Our team at NCS Global is experienced in handling diverse cases, including foreign income and tax credits, ensuring that your clients receive accurate and timely filings.

We know that 67% of CPAs believe that complex client situations take up most of their time during tax season.

3. Documentation Assistance

Client documentation often causes delays in tax preparation, leading to potential penalties. NCS Global addresses this issue with a streamlined document collection system that efficiently collects, verifies, and organises client data. This approach saves time and minimises the risk of missing paperwork, reducing the need to chase clients for documents like W-2s or receipts.

4. Minimising Compliance Risks

Compliance is crucial, as missing steps can be costly for CPAs and clients. NCS Global offers quality assurance by reviewing tax returns for compliance, helping CPAs reduce risks and ensure accuracy without extensive double-checking.

NCS Global: Ready at Every Step for CPAs

When we say that NCS Global is ready to assist, we mean it. Here’s how we’re prepared at every stage of the tax preparation process:

- Pre-Filing Assistance: Before filing begins, we assist in organising and managing client documentation, ensuring that you have everything in place before starting the return.

- Filing Stage: Our team works alongside you, managing the bulk of the data entry and calculations.

- Post-Filing Support: Once Form 1040 is filed, there are often follow-ups, client questions, or even audits. We offer post-filing assistance, including response preparation, IRS notice handling, and audit preparation. With over 30% of taxpayers receiving IRS follow-up queries, our support is crucial.

Key Benefits of Partnering with NCS Global:

- Scalable Support: Whether you need assistance during peak seasons or all year round, our services are scalable based on your needs.

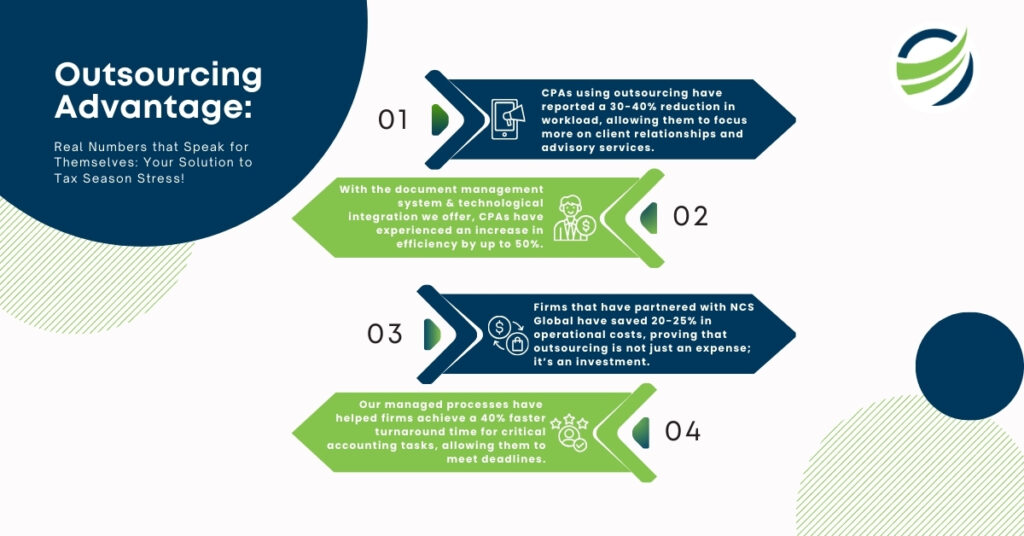

- Cost-Effective Solutions: Outsourcing tax preparation to NCS Global can be a cost-effective solution. It allows CPAs to focus on higher-level advisory services rather than getting bogged down with day-to-day returns, ultimately leading to better utilisation of resources.

- Quality Assurance: We provide an additional layer of review to ensure that all forms are accurate and compliant with the latest IRS guidelines.

- Advanced Technology: We use the latest software and technology to simplify data management, minimise errors, and expedite tax preparation. With NCS Global technology-driven approach, CPAs can handle more clients in less time.

Conclusion:

CPAs encounter challenges in managing client expectations, handling complex situations, and complying with changing tax laws. NCS Global offers outsourced tax preparation to ease their workload, reduce stress, and allow CPAs to concentrate on delivering strategic services to clients.

With NCS Global expertise, CPAs can handle more clients, reduce the risk of compliance issues, and use their time for high-value tasks rather than repetitive paperwork. If you are a CPA looking for ways to manage your processes, ensure quality, and scale your operations, consider how NCS Global can transform your practice – one tax return at a time.