- November 5, 2024

- by NCS Global

- 6mins read

Finding Solutions to the Accountant Shortage Crisis

The accounting profession is facing a serious shortage, which is particularly evident in the United States. According to the AICPA , there has been a noticeable decline in the number of newly certified public accountants entering the workforce, creating significant gaps for firms and companies alike. For CPAs and accountants, this poses both a challenge and an opportunity.

The Root of the Problem: Why Are There Fewer Accountants?

Over the past decade, fewer students have chosen accounting as a major, and many experienced accountants are retiring. Between 2010 and 2020, the number of accounting graduates decreased by nearly 7%. This shortage has left firms struggling to fill critical roles.

Moreover, the rise of technology has drastically changed the landscape of accounting. Automated software, cloud-based solutions, and AI-driven tools have simplified many tasks, but these advancements cannot fully replace the analytical and strategic skills that seasoned accountants bring to the table.

How Skilled Accountant Shortages Can Affect the Global Economy

The shortage is already having a significant impact on both firms and their clients. With fewer accountants available, firms are struggling to keep up with the increased demand for services. This is especially true during the busy tax season, where many firms are forced to turn away clients or delay work due to capacity constraints.

For businesses, this shortage means delayed financial reporting, longer audit times, and even a higher likelihood of errors in financial statements. The pressure to hire and retain top accounting talent has also driven up wages, which in turn increases operating costs for firms and corporations.

As demand continues to outpace supply, it is clear that firms need to think outside the box to address the shortage.

The Creative Solution to Beating the Accountant Shortage in the U.S.

Given the current state of the industry, CPA firms must adopt innovative strategies to cope with the shortage. Below are some actionable solutions that firms and businesses can implement.

1. Outsourcing Accounting Functions:

One of the most immediate solutions is to outsource certain accounting functions to external firms or consultants. This approach allows companies to access specialised expertise without the need for full-time hires. Firms like NCS Global, for instance, offer outsourced accounting solutions that allow businesses to focus on high-value tasks while delegating more routine functions such as data entry, payroll management, and tax preparation.

Outsourcing can be particularly beneficial during peak seasons, such as tax filing deadlines, when the internal team is stretched thin. Leveraging external resources not only boosts capacity but can also lower operational costs—outsourced solutions can reduce costs by up to 30% compared to maintaining a full-time in-house team.

2. Adopting Automation and Technology:

While technology cannot replace human accountants, it can complement their work by streamlining repetitive and mundane tasks. Automation software, such as Xero and Intuit QuickBooks, can handle much of the data entry, reconciliations, and basic bookkeeping, allowing accountants to focus on more strategic and advisory roles.

In fact, studies show that firms that invest in automation technologies report productivity increases of up to 50% for certain tasks. By optimising workflows with these tools, firms can reduce the manual labor required, thus offsetting the pressure from the talent shortage.

3. Upskilling and Retaining Talent:

Retaining existing talent is crucial during times of shortage. Firms should invest in upskilling their current workforce to fill gaps created by retiring accountants. Offering opportunities for ongoing education, certifications, and specialised training can increase job satisfaction and enhance employees’ skills, making them more valuable to the firm.

Moreover, fostering a strong company culture that promotes work-life balance can help in retaining skilled professionals. A recent study found that 85% of accountants cite work-life balance as a key factor in their job satisfaction. Firms that prioritise these needs will have a higher retention rate, reducing the constant churn of employees and maintaining institutional knowledge.

4. Attracting the Next Generation of Accountants:

To combat the declining number of accounting graduates, firms and industry associations must actively work on attracting the next generation of CPAs. Mentorship programs, internships, and career development opportunities are critical in drawing young talent into the profession.

Additionally, promoting the diversity of career paths within accounting can help broaden its appeal. Today’s accountants can specialise in areas like forensic accounting, data analytics, or financial consulting, offering a wide range of fulfilling and impactful career options.

5. Partnering with Educational Institutions:

Firms should consider partnering with local universities and colleges to create tailored programs for accounting students. By offering scholarships, internships, and mentorship opportunities, firms can foster a pipeline of new talent. These partnerships allow students to gain real-world experience while also easing their transition into the workforce.

AICPA’s Response to the Talent Shortage:

The American Institute of CPAs (AICPA) is actively working to address the talent shortage through several initiatives:

- CPA Evolution Initiative: This program aims to modernise the CPA licensure model by emphasising skills in technology, data analysis, and strategic thinking. This update is designed to attract more young professionals by making the profession more relevant to today’s business environment.

- Scholarships and Educational Support: The AICPA offers scholarships and grants to encourage more students to pursue accounting degrees and certification.

- Promoting CPA Licensure: The AICPA continues to promote the value of CPA certification to strengthen the profession and increase the number of qualified accountants.

How Bad is the Accounting Shortage in the U.S., and What Can Be Done?

The U.S. is facing a significant accounting shortage, and the impact is becoming more severe each year. Declining numbers of accounting graduates, a wave of retirements, and the rise of technology are all contributing to this crisis.

The Scale of the Shortage:

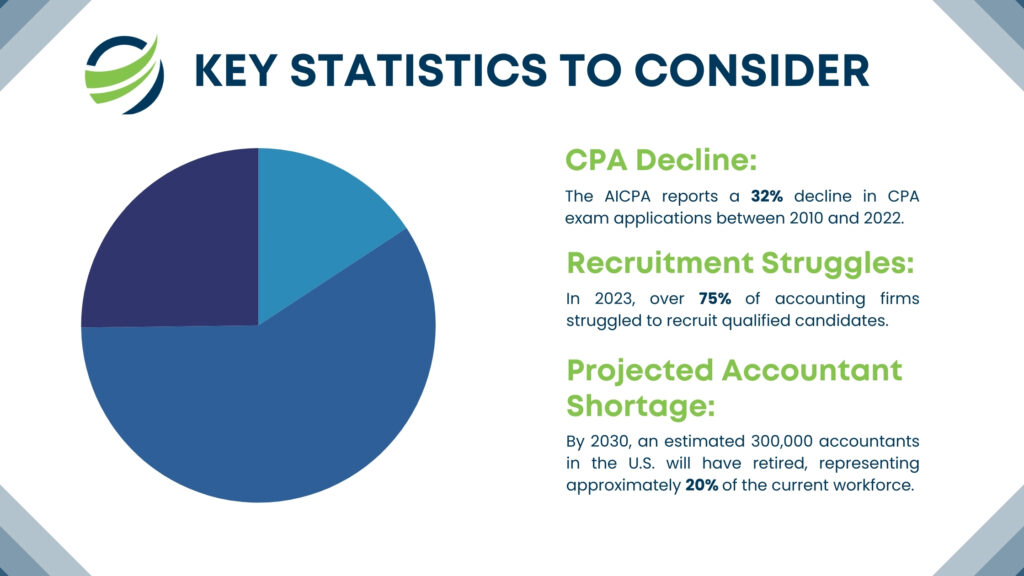

- CPA exam candidates dropped by 32% between 2010 and 2022, and over 300,000 accountants are expected to retire by 2030.

- 75% of firms report difficulty in hiring qualified accountants, further straining their ability to meet client needs.

- Fewer students are pursuing accounting degrees, with the number of graduates down by 7% in the past decade.

How CPAs Can Take Advantage of the Situation:

For CPAs and accountants already in the field, the shortage presents a unique opportunity to expand their influence and client base. As demand for qualified accountants increases, professionals who can demonstrate expertise and reliability will be in a strong position to command higher fees and offer more specialised services.

By positioning themselves as trusted advisors rather than simply number crunchers, CPAs can help clients navigate complex tax laws, manage cash flows, and plan for long-term financial health. Additionally, CPAs who embrace technology and offer digital solutions to clients will have a competitive edge in this evolving landscape.

Overcoming the Shortage with the Right Tools and Mindset:

The accounting shortage presents challenges, but it can be overcome with the right strategies:

- Outsourcing and Automation: Firms can outsource accounting tasks and embrace automation to manage workloads efficiently.

- Encouraging Education and Certification: Promoting the CPA profession and investing in educational initiatives will help attract new talent.

- Embracing Technology: Using technology to automate routine tasks will allow accountants to focus on providing strategic insights to clients.

- Retention and Work-Life Balance: Fostering a healthy work-life balance for existing employees can reduce burnout and improve retention.

How NCS Global can help you:

NCS Global is playing a key role in helping businesses cope with the shortage by providing outsourced accounting services and leveraging automation tools to manage manual tasks:

- Automating Manual Accounting Tasks: NCS Global uses technology to handle routine tasks like data entry, payroll processing, and accounts payable, freeing up accountants to focus on higher-level advisory roles.

- Outsourcing Services: NCS Global offers outsourced solutions, allowing businesses to access skilled professionals without needing full-time hires, helping reduce costs and meet demand.

Conclusion: Thriving Amid the Shortage

The accountant shortage crisis is unlikely to be resolved overnight, but firms that adopt proactive solutions can not only survive but thrive in this challenging environment. By outsourcing non-core functions, investing in technology, retaining and upskilling talent, and attracting the next generation of accountants, firms can position themselves for long-term success.

For CPAs and accountants, now is the time to capitalise on the increased demand for services by expanding expertise, leveraging technology, and offering value-added advisory roles.

Are you prepared to enhance your practice? Collaborate with NCS Global today and explore how outsourcing can enable your firm to flourish despite the current shortage.