- October 11, 2024

- by NCS Global

- 5mins read

The Importance of Timely Tax Preparation: Avoiding Common Pitfalls

Tax season can be a stressful time for individuals and businesses alike. The pressure to file accurate returns, meet deadlines, and avoid costly mistakes can often feel overwhelming. However, timely tax preparation plays a crucial role in minimising stress, ensuring compliance with tax laws, and avoiding common pitfalls that could lead to penalties. In this article, we will explore the importance of preparing taxes on time, discuss the most frequent mistakes taxpayers make, and offer strategies for overcoming these challenges.

1. Why Timely Tax Preparation is Essential

Timely tax preparation is about more than just meeting deadlines. It involves carefully planning, organising, and filing tax returns in a way that maximises your financial benefits while adhering to legal requirements. Filing your taxes on time offers several advantages:

Avoiding Penalties: The IRS charges interest and penalties for late filings or payments.

Maximising Refunds: Claiming deductions and credits before they expire.

Preventing Errors: Rushing to file taxes increases the risk of mistakes.

Maintaining Financial Health: Keeping your cash flow steady by planning for tax liabilities.

2. Common Pitfalls in Tax Preparation

While tax preparation may seem straightforward, many people fall victim to common errors that can lead to complications. Some of the most frequent mistakes include:

Incorrect Data Entry: Entering wrong figures for income, deductions, or credits.

Overlooking Deductions or Credits: Failing to claim all eligible deductions and credits.

Missing Deadlines: Failing to submit returns or payments on time.

Misclassification of Income: Reporting income in the wrong category (e.g., earned vs. passive income).

Failure to Keep Proper Documentation: Not maintaining records of receipts, payments, and deductions.

These risks are especially common among taxpayers who leave their filings to the last minute. By starting early, you have more time to double-check your numbers, avoid errors, and gather all necessary paperwork.

3. Benefits of Early Tax Preparation

Starting your tax preparation process early can help you avoid many of the pitfalls mentioned above. Some of the key benefits include:

Less Stress: You have more time to organise your financial records.

Better Financial Planning: You can estimate your tax liability ahead of time and set aside funds.

Fewer Errors: With ample time, you can review your forms and ensure accuracy.

Access to Professional Help: Tax professionals are often booked during the busy season, so early filers can access expert help without delays.

A survey by the National Society of Accountants revealed that 34% of tax professionals recommended starting preparations as early as January to ensure error-free and timely filing.

4. The Consequences of Late Filing

Failing to file taxes on time can have serious consequences, both financially and legally. Some of the most common repercussions include:

Late Fees and Penalties: The IRS imposes a failure-to-file penalty of 5% per month, up to a maximum of 25%, for late returns.

Interest on Unpaid Taxes: Interest accrues daily on unpaid tax amounts starting from the due date of the return.

Reduced Refunds: If you’re entitled to a refund but fail to file within three years, you forfeit the refund.

Increased Risk of Audit: Late filers are more likely to be flagged for an audit by the IRS.

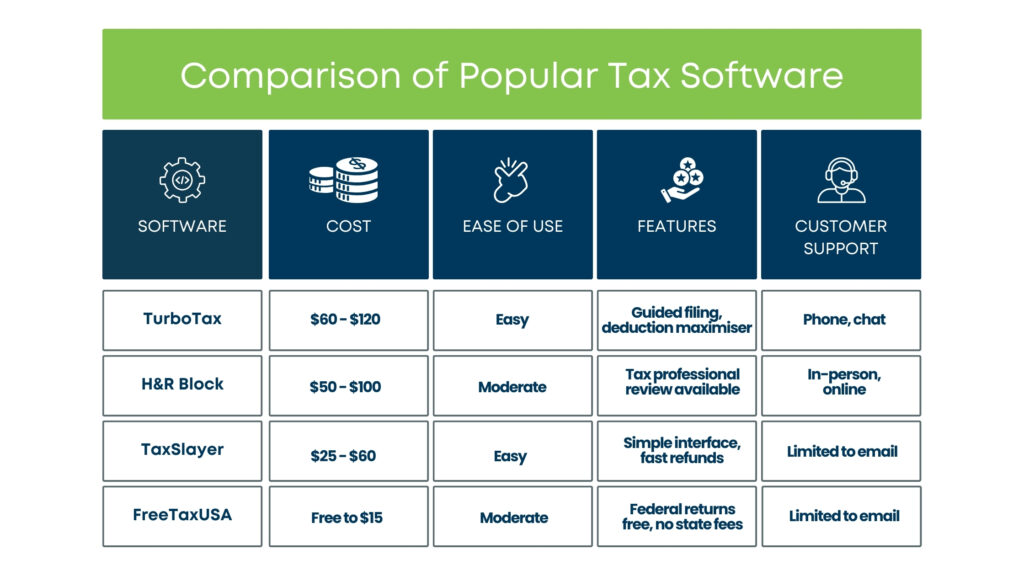

5. The Role of Tax Software in Timely Filing

In today’s digital age, tax preparation software has become an invaluable tool for many taxpayers. These platforms streamline the filing process by automating calculations, identifying potential deductions, and ensuring compliance with tax laws.

6. Professional Tax Advisors: When to Seek Help

While tax software can be a great tool for many, there are situations where seeking help from a tax advisor or CPA is a better option. For instance:

Complex Financial Situations: If you own multiple properties, have international income, or are self-employed, a tax professional can provide valuable guidance.

Tax Planning Needs: For high-net-worth individuals or businesses, tax advisors can help create strategies to minimise tax liabilities.

Audits and Legal Issues: If you’ve been flagged for an audit or have unresolved tax issues, hiring a tax professional can help you navigate the process.

The average fee for hiring a CPA for tax filing ranges from $200 to $500 depending on the complexity of the return. However, the expertise and peace of mind that come with hiring a professional can be well worth the cost.

7. Avoiding the Pitfalls of Last-Minute Filing

One of the biggest risks associated with last-minute tax filing is the higher likelihood of errors. Taxpayers who rush to file often overlook crucial deductions, misreport income, or forget to include necessary forms. To avoid these common mistakes:

Set Reminders: Use calendars or apps to track tax deadlines and milestones.

Organise Documents: Keep all tax-related documents in one place throughout the year.

Use a Checklist: Follow a tax preparation checklist to ensure you don’t miss any steps.

Start Early: Begin preparing your return well in advance of the deadline to avoid the rush.

8. State vs. Federal Taxes: Key Differences

Many taxpayers must navigate both federal and state taxes when preparing their returns. Each jurisdiction has different rules, deadlines, and tax rates. Here are some key differences:

Filing Deadlines: Federal returns are due by April 15, but state deadlines may vary.

Deductions and Credits: Some deductions available at the federal level may not apply to state taxes.

Tax Rates: State tax rates vary significantly, with some states like Texas and Florida having no income tax, while others like California impose higher rates.

Understanding the difference between federal and state tax laws is crucial for ensuring compliance and avoiding errors.

9. Tax Deadlines to Keep in Mind

Meeting tax deadlines is essential for avoiding penalties and interest. Here are some important dates to remember:

January 31: Deadline for receiving W-2 and 1099 forms.

April 15: Deadline for filing federal income tax returns (or filing for an extension).

October 15: Final deadline for filing federal returns if an extension was granted.

State tax deadlines may differ, so it’s important to check with your local tax authority.

10. Conclusion: Proactive Planning is Key

In conclusion, timely tax preparation is about ensuring accuracy, maximising refunds, and avoiding costly mistakes. By staying organised, using the right tools, and seeking professional help when needed, you can successfully navigate tax season with minimal stress.

NCS Global team of experienced accountants leverages advanced tools and proven processes to ensure high levels of accuracy in tax preparation. By outsourcing, accountants and financial advisors can rest assured that errors are minimised, leading to smoother operations and satisfied clients.

By taking the time to prepare your taxes early and correctly, you’re setting yourself up for a smoother tax season and a stronger financial future.